UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2015

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM__________ TO ____________

Commission file number: 000-31355

| FTE NETWORKS, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 81-0438093 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 999 Vanderbilt Beach Rd., Suite 601, Naples, Florida 34108 |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code: 1-877-878-8136

Securities registered pursuant to Section 12(b) of the Act: Not Applicable

Securities registered pursuant of section 12(g) of the Act: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is well-known seasoned issuer, as defined in Rule-405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Note-Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports require to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§ 235.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þYes o No

Indicate by check mark if disclosure of delinquent filers pursuant of Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definite proxy of information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “larger accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| None-accelerated filer ¨ | (Do not check if a smaller reporting company) | Smaller Reporting Company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

As of March 31, 2015, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was indeterminate because the Company’s common stock was not listed, traded or quoted on any national stock exchange during this period.

As of January 8, 2016, there were 46,386,220 shares of common stock outstanding.

FTE NETWORKS, INC.

FORM 10-K

TABLE OF CONTENTS

FISCAL YEAR ENDED SEPTEMBER 30, 2015

Some of the statements in this Annual Report on Form 10-K may be “forward-looking statements.” Forward-looking statements are not historical facts but include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict.

Forward-looking statements can be identified by the use of terminology such as "estimates," "projects," "plans," "believes," "expects," "anticipates," "intends," or the negative or other variations, or by discussions of strategy that involve risks and uncertainties. We urge you to be cautious of the forward-looking statements which are contained in this Annual Report on Form 10-K because they reflect our current beliefs with respect to future events and involve known and unknown risks, uncertainties and other factors affecting our operations, market growth, services, products and licenses. No assurances can be given regarding the achievement of future results, as actual results may differ materially as a result of the risks we face, and actual events may differ from the assumptions underlying the statements that have been made regarding anticipated events. Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include, without limitation:

| • | Our ability to maintain sufficient liquidity; |

| • | Our ability to attract and retain key personnel and temporary workers; |

| • | Our ability to collect account receivables; |

| • | Our ability to manage the growth of our operations and effectively integrate acquisitions; |

| • | Our ability to retain our key customers and market share; |

| • | Our ability to compete for suitable merger prospects; |

| • | Our ability to successfully integrate future acquisitions; |

| • | Our ability to satisfy our service level agreements; |

| • | Our ability to effectively manage our backlog; |

| • | The impact of legislative actions and significant regulations on our business; |

| • | Our ability to adapt to swift changes in the telecommunications industry; |

| • | The effectiveness of our physical infrastructure and services; |

| • | Fluctuations in general conditions; |

| • | Our ability to comply with regulations; |

| • | The effects of any employment related to other claims against our business; |

| • | Our ability to maintain workers’ compensation insurance coverage at commercially reasonable terms; and |

| • | Our ability to raise capital when needed and on acceptable terms and conditions. |

All written and oral forward-looking statements made in connection with this Annual Report on Form 10-K that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Any forward looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this Annual Report on Form 10-K. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

| 1 |

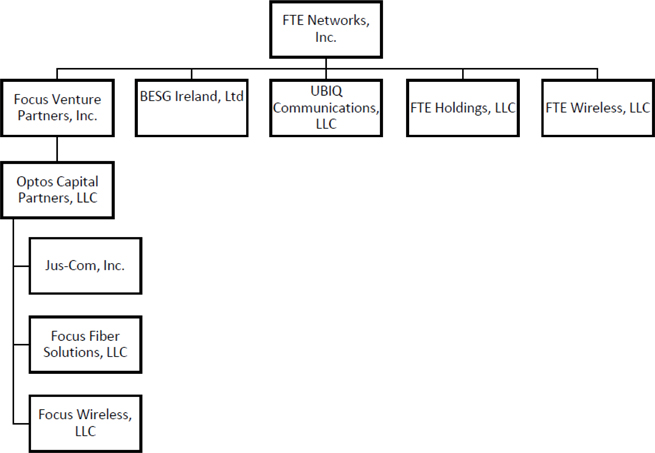

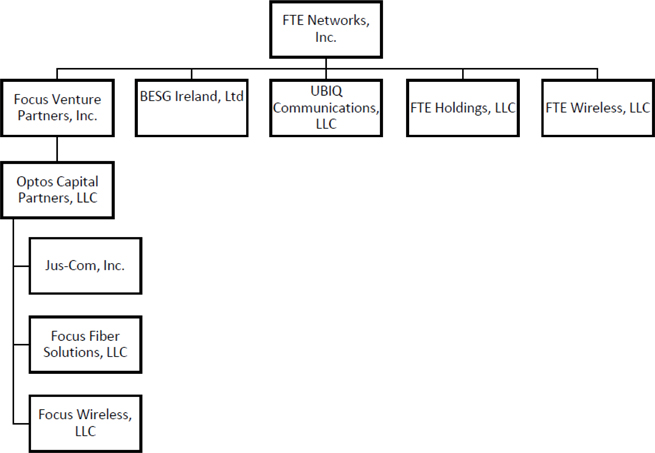

FTE Networks, Inc., (“FTE Networks, the “Company”, “we” or “us”) and subsidiaries, is a provider of international and regional telecommunications and technology systems and infrastructure services. FTE also offers managed information technology, telecommunications services, subscriber based services and staffing solutions through its wholly-owned subsidiaries:

| · | Jus-Com, Inc., (dba FTE Network Services) specializes in the design, engineering, installation, and maintenance of all forms of telecommunications infrastructure. Services including engineering consulting, design, installation, maintenance, and emergency response in various categories including cabling, equipment installation and configuration, rack and stack, wiring build-outs, infrastructure build-outs, DC power installation, OSP/ISP fiber placement, fiber cable splicing and testing. |

| · | FTE Wireless, LLC, offers wireless solutions to major wireless carriers including equipment installation, fiber backhaul, antennae installation and testing, small cell solutions, fiber-to-site and other turnkey solutions as needed by such clients. |

| · | Focus Venture Partners, Inc. (dba FVP Worx) is a multifaceted employment firm offering full service staffing solutions, specializing in the telecommunications, technology and construction services industries. |

CORPORATE HISTORY

Prior to Beacon Merger

Beacon Enterprise Solutions Group

Beacon Enterprise Solutions Group, Inc. (“Beacon”) was incorporated in the state of Nevada on December 30, 2007. On September 5, 2012 Beacon sold its operating assets and Beacon ceased its business operations, in order to meet its financial obligations and avoid bankruptcy, but maintained its public company “shell” status.

Focus Venture Partners, Inc.

Focus Venture Partners, Inc. (“Focus”) was incorporated in the state of Nevada on March 26, 2012 as a holding company operating in the telecommunications industry managing and developing its wholly owned subsidiaries, which were focused on the development of telecommunications networks, acting as a service and support provider, as well as providing temporary and part-time staffing solutions.

Through Optos Capital Partners, LLC, a Delaware limited liability company (“Optos”), its wholly owned subsidiary, Focus operated the following wholly owned entities:

| · | Focus Fiber Solutions, LLC, a Delaware limited liability company (“Focus Fiber”), which specialized in the design, engineering, installation, and maintenance of a telecommunications infrastructure network. |

| · | JusCom, Inc., an Indiana corporation (“JusCom”), which was a telecommunication service provider providing various services including engineering consulting, design, installation and emergency response in various categories including cable rack/wiring buildouts, infrastructure buildouts, DC power installation, fiber cable splicing and security camera installation. JusCom also operated as a temporary and permanent staffing agency specializing in the telecommunications market. Prior to the Beacon Merger, Focus reorganized such that Jus-Com became a subsidiary of Focus, and was no longer a subsidiary of Optos. |

| 2 |

Beacon Merger

On May 10, 2013, Beacon and Beacon Acquisition Sub, Inc. a Nevada corporation and a wholly owned subsidiary of Beacon (the “Merger Sub”) entered into a merger agreement with Focus (the “Merger Agreement”). Pursuant to the Merger Agreement, the Merger Sub merged with and into Focus, with Focus continuing as the surviving corporation, with the result that Focus became a subsidiary of Beacon (the “Beacon Merger”). The closing of the merger took place on June 19, 2013.

For accounting purposes, the Beacon Merger has been treated as an acquisition of Beacon, and a recapitalization of Focus Venture Partners. The historical consolidated financial statements prior to June 19, 2013 are those of Focus Venture Partners. In connection with the Beacon Merger, Focus Venture Partners has restated its statements of stockholders’ deficiency on a recapitalization basis so that all equity accounts are presented as if the recapitalization had occurred as of the beginning of the earliest period presented.

In connection with the Beacon Merger, the Board of Directors authorized the designation of a new series of preferred stock, the Beacon Series D Shares, out of its available “blank check preferred stock” and authorized the issuance of up to 2,000,000 Beacon Series D Shares. We filed a Certificate of Designation with the Secretary of State of the State of Nevada on June 17, 2013. Under the Certificate of Designation, each Beacon Series D Share has various rights, privileges and preferences, including: (i) a stated value of $4.00 per share; (ii) mandatory conversion into 20 shares of Common Stock (subject to adjustments) upon the filing of the amendment to our Articles of Incorporation after incorporating the 1 for 20 reverse stock split of the outstanding shares of common stock required by the Merger Agreement (and an effective increase in the Company’s authorized common stock); and (iii) a liquidation preference in the amount of the stated value. To date, as a result of our non-compliance with our reporting obligations (see “The Registration and Trading of Our Securities,” on page 5 below), the Company has not been able to obtain the necessary approval from the Financial Industry Regulatory Authority (“FINRA”) for the 1-for-20 reverse stock split required by the Beacon Merger. We have begun the process to request approval for the 1-for-20 reverse stock split following the effectiveness of our registration statement on Form 10 and the resumption of trading in the securities of the Company, which will result in the mandatory conversion of the Series D preferred shares into post-split shares of common stock.

In connection with the Beacon Merger the Board of Directors authorized the designation of a new series of preferred stock, the Beacon Series E Shares, out of its available “blank check preferred stock” and authorized the issuance of up to 1,000,000 Beacon Series E Shares. We filed a Certificate of Designation with the Secretary of State of the State of Nevada on June 17, 2013. Under the Certificate of Designation, each Beacon Series E Share has various rights, privileges and preferences, including (i) a liquidation value of $1.00 per share (subject to adjustments); (ii) mandatory redemption of 10,000 shares per month at the liquidation value; and (iii) conversion at the option of the Company of all outstanding Beacon Series E Shares at a price equal to half the liquidation value after 48 mandatory redemption payments have been made.

Pursuant to the terms of the Merger Agreement: (i) shares of Series B Preferred Stock of Focus, par value $0.0001 per share (the “Focus Preferred B Shares”) and common stock of Focus, par value $0.0001 per share (the “Focus Common Stock”) were converted into the right to receive an aggregate of 1,250,011 shares of Beacon Series D Preferred Shares, par value $0.01 per share); (ii) all shares of Series A Preferred Stock of Focus, par value $0.0001 per share, were converted into the right to receive an aggregate number of 1,000,000 shares of Beacon Series E shares, par value $0.01 per share, (iii) all shares of capital stock of Merger Sub were converted into one share of Focus Common Stock. Each Beacon Series D and Beacon Series E share is entitled to vote alongside the common stockholders and has 20 and 1 vote(s) each, respectively. The Beacon Series E shares were subject to redemption and were recorded as a liability, but the shares were returned to the Company and derecognized on September 30, 2013. The Beacon Merger represented a change of control of Beacon and Focus management became responsible for the consolidated entity.

The consideration issued in the Merger was determined as a result of arm’s length negotiations between the parties.

| 3 |

Changes Resulting from the Merger

Our mission is to expand the operations of Jus-Com Inc. dba FTE Network Services as our primary line of business. Jus-Com is headquartered in Naples, Florida specializing in the design, engineering, installation, construction and maintenance of telecommunications and technology networks and infrastructure.

Following the Beacon Merger, on March 13, 2014, Beacon changed its name to “FTE Networks, Inc.” (“FTE” or the “Company”). JusCom began doing business as FTE Network Services (“FTE Network Services”) – a turn-key infrastructure services company. Focus Venture Partners began doing business as FVP Worx, Inc., offering full service staffing solutions. Optos Capital Partners remains as a non-operating shell held for the purpose of future diversification opportunities. The following graphic depicts our organization following the Beacon Merger and the organizational changes described above, and represents the current organization of the Company:

| 4 |

RECENT DEVELOPMENTS

The Registration and Trading of Our Securities

Prior to September 12, 2014 (the “Revocation Date”), our Common Stock was registered under Section 12(g) of the Exchange Act of 1934, as amended (the “Exchange Act”). Pursuant to such registration, the Company was subject to the requirements of Regulation 13(a) of the Exchange Act which required us to file with the SEC, in part, annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

After we ceased our business operations and became a public company “shell” on September 5, 2012, we fell behind on the compilation of our books and records, due to challenges related to staffing, access to historical data and insufficient funding. Consequently, we failed to comply with the reporting requirements of Regulation 13(a) of the Exchange Act. Further, the Company underestimated the time that it would take for the registrant to access and analyze the historical data to enable it to become current in its financial reporting. As a result, on August 20, 2014, the U.S. Securities and Exchange Commission (the “SEC”), via Release No. 72872, ordered the commencement of an Administrative Proceeding (File No. 3-16024) with respect to the Company. The SEC observed and asserted that the Company had failed to comply with its obligations under Exchange Act Section 13(a) and Rules 13a-1 and 13a-13 thereunder because the Company had not filed any periodic reports with the SEC since the period ended June 30, 2012. Also on August 20, 2014, in connection with the foregoing, the SEC announced the temporary suspension of trading in the securities of the Company.

Subsequently, on September 8, 2014, the Company entered into an Offer of Settlement with the SEC regarding the Administrative Proceeding (File No. 3-16024) whereby, in part, the Company consented to the entry of an Order by the SEC containing the findings that: (1) the Company was a Nevada corporation located in Naples, Florida with a class of securities registered with the Commission under Exchange Act Section 12(g) and as of August 18, 2014, the common stock of the Company (symbol FTNW) was quoted on OTC Link (formerly “Pink Sheets”) operated by OTC Markets Inc., had ten market makers, and was eligible for the “piggyback” exception of Exchange Act Rule15c2-11(f)(3); (2) the Company had failed to comply with Exchange Act Section 13(a) and Rules 13a-1 and 13a-13 thereunder because it had not filed any periodic reports with the SEC since the period ended June 30, 2012; and that on the basis of the foregoing (3) pursuant to Section 12(j) of the Exchange Act, registration of each class of the Company’s securities registered pursuant to Exchange Act Section 12 be revoked.

As such, on the Revocation Date, via Release No. 73085, the SEC ordered that, effective immediately pursuant to Section 12(j) of the Exchange Act, the registration of each class of the Company’s securities registered pursuant to Exchange Act Section 12 be revoked.

Following the above described revocation of registration, on March 17, 2015 we filed a registration statement on Form 10, to once again register our Common Stock pursuant to Section 12(g) of the Exchange Act. On May 16, 2015, the registration statement became effective, and we are again subject to the requirements of Regulation 13(a) of the Exchange Act, which requires us to file, in part, annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we are required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

On December 10, 2015, our common stock resumed trading on the OTC Pink marketplace.

| 5 |

Authorization of Series F Preferred Stock

The Board of Directors of the Company authorized the designation of a new series of preferred stock, the Series F Stock (“Series F Stock”), out of its available “blank check preferred stock” and authorized the issuance of up to 1,980,000 shares of the Series F Stock. A Certificate of Designation was filed with the Secretary of State of the State of Nevada on November 2, 2015. The Series F Stock has various rights, privileges and preferences, including: (i) a stated value of $4.00 per share; (ii) conversion into 20 shares of Common Stock (subject to adjustments) upon the filing of an amendment to the Company’s Articles of Incorporation incorporating a reverse stock split; and (iii) a liquidation preference in the amount of the stated value.

Entry into a Credit Facility and Repayment of Senior Secured Notes

On November 3, 2015, the Company entered into a credit agreement (the “Agreement”) pursuant to which the Company received $8 million in term loans from Lateral Investment Management (“Lateral”). A portion of the proceeds was used to extinguish an aggregate principal amount of approximately $3.5 million of Senior Secured Promissory Notes, pursuant to a tender offer. The noteholders who tendered their notes received the tender offer consideration of $0.50 per $1 principal amount of the Notes from the proceeds from the term loan, and all interest payable on the notes was forgiven. The Company expects to recognize approximately a $3.5 million gain related to the extinguishment of the Senior Secured Promissory Notes.

In connection with the agreement, the Company issued 555,344 shares of Series F preferred stock to Lateral. The Company and Lateral also entered into a registration rights agreement (“Registration Rights Agreement”) in connection with the issuance of these shares, pursuant to which the Company must file a registration statement with the SEC, with respect to the shares. Lateral may request redemption of some or all of its Series F preferred stock any time after October 28, 2017, subject to the Company (a) meeting certain minimum capitalization and EBITDA requirements; and (b) being able to continue as a going concern on a post-redemption basis. The redemption price per share is variable and equals 10 (ten) times the last twelve months EBITDA, multiplied by the Lateral fully-diluted ownership percentage and then divided by the Lateral Series F preferred stock shares outstanding. In addition, Lateral was granted anti-dilution rights which permit it to receive additional equity securities to maintain its fully-diluted ownership interest to the extent that the Company issues equity securities to third parties, up to a maximum of $5,000,000. Furthermore, so long as Lateral maintains a fully-diluted ownership interest of 10% or more, the Company may not without Lateral’s consent (a) enter into new indebtedness exceeding $400,000; (b) undertake a Major Transaction Event (as defined); or (c) terminate or replace its Chief Executive Officer.

TELECOMMUNICATIONS INFRASTRUCTURE SERVICES INDUSTRY

FTE Network Services provides comprehensive telecommunications solutions to Fortune 500 customers in the wireline and wireless telecommunications industry. Services performed by FTE include the design, engineering, installation, repair and maintenance of fiber optic, copper and coaxial cable networks used for video, data and voice transmission. In the wireless space, FTE provides engineering, design, installation and upgrade of wireless communications networks, including infrastructure, antennas, switching systems, and backhaul links from wireless systems to voice, data and video networks. FTE also provides emergency restoration services, including the repair of telecommunications infrastructure damaged by inclement weather. We also provide premise wiring where we install, repair, and maintain the telecommunications structure within improved structures.

FTE Network Services’ success in these technology spaces is the result of experienced management and leadership, purchasing relationships and logistics, project planning, project management disciplines, training, quality control and top down commitment to customer satisfaction.

| 6 |

We believe that certain provisions of the American Recovery and Reinvestment Act of 2009 (“ARRA”) will continue to create additional demand for our services. Specifically, the ARRA includes federal stimulus funding for the deployment of broadband services to underserved areas that lack sufficient bandwidth to adequately support economic development. We also expect many customers who received stimulus funds to continue to expand their networks even though stimulus funding may no longer be available.

The combination of a growing North American wireless subscriber base, greater use of wireless data for consumer and enterprise applications and services, and the development of innovative consumer wireless data products has led to a significant increase in the amount of wireless data traffic on wireless networks. As a result, the traditional backhaul infrastructure that has historically linked wireless cell sites to broader voice, data and video networks is reaching capacity. To handle current and future wireless data traffic demands and to improve wireless network quality and reliability, wireless carriers are implementing plans to replace their legacy backhaul networks based on T-1 lines and circuit switching applications with fiber optic networks, typically referred to as “fiber to the cell site” initiatives. We believe these initiatives will continue several more years before the backhaul system upgrade is completed, resulting in additional opportunities to assist our wireless customers in their fiber to the cell site initiatives.

We anticipate increased long-term opportunities arising from plans by a number of wireless companies to deploy and implement 4G and LTE (Long Term Evolution) and XLTE (Extended Long Term Evolution) technology and networks throughout North America. These technologies are being deployed in the United States using a new spectrum, which effectively requires an entirely new network to be built. As a result, we expect significant capital expenditures will be made over a relatively long period of time as wireless carriers build out their 4G and LTE networks and then augment and optimize their networks for reliability and network quality. We believe wireless carriers are in the very early stages of their 4G and LTE network deployment plans.

Fiber to the X (“FTTx”) comprises the many variants of fiber optic access infrastructure. These include fiber to the home (“FTTH”), fiber to the premise (“FTTP”), fiber to the building (“FTTB”), fiber to the node (“FTTN”), and fiber to the curb or cabinet (“FTTC”). GIA announces the release of a comprehensive global report on Fiber Optic Components market. Global market for Fiber Optic Components is projected to reach US$42 billion by the year 2017. Growth will be driven by the continuously growing demand for bandwidth and the ensuing need for fiber-based broadband, robust growth in mobile internet, and stronger FTTx related deployments.

Outside Plant Operations

Outside Plant Operations (OSP) includes all forms and methods of connecting the nation’s telecommunications infrastructure. Historically this work has been with copper and then coax. Today, it is predominately aerial and buried fiber. FTE builds outside plant for large corporate customers, government entities and private investors.

FTE Network Services has scaled to approximately 200+ concurrent crews in multiple geographies representing multiple customers and multiple projects. FTE Network Services’ success is based on several factors:

| · | Staff construction experience in these markets over many years in the past provides an understanding of the challenges in most every market with respect to local regulations to diverse soil types and rock formations. |

| · | FTE has a network of seasoned Project Managers and Construction Managers that it leverages in all markets on all projects. |

| · | FTE uses a blend of self-perform and sub-contract that maintains internal quality standards and allows the company to expand operation rapidly and likewise downsize at completion preserving company profitability. |

| · | FTE creates a local presence for all projects with local office and warehouse space to run and manage the project and handle materials logistics respectively. |

| · | FTE has relationships with major national suppliers for everything from heavy equipment to custom order fiber optic cable. |

| 7 |

| · | All contract outside plant (“OSP”) operations are fulfilled with a combination of our fleet of aerial trucks, underground plows, directional drills, fiber placement crews, and fiber splicers. |

| · | All equipment used on OSP projects is mobile, with dedicated logistics to service these projects as demands change. FTE Network Services can meet any scheduling requirement and accommodate changing demands by calling on its extensive network of strategic partners. |

| · | Finally, FTE itself has a broad base of experienced operators and installers dedicated to each project, and we are committed to providing the necessary personnel and equipment to meet the demands of every engagement. |

Inside Plant Operations

Inside Plant Operations (ISP) are services provided to major telecommunications services providers in their switching and processing facilities. The scope of services includes the following:

| · | Cable rack / wiring build-outs |

| · | Infrastructure build-outs |

| · | DC power installation |

| · | Battery installation / maintenance |

| · | Uninterrupted power source (“UPS”) installation |

| · | Power distribution unit (“PDU”) installation |

| · | Fiber cable splicing |

| · | Structured cable installation |

| · | All low-voltage cable installation |

| · | Provisioning, test, turn-up of FTTP, FTTN, FTTH, FTTx. |

| · | Security camera installation |

| · | AC circuits & conduit builds |

Each major telecommunications client has their own build and quality standards. FTE trains its technicians in each specific protocol and has quality standards that it maintains on each and every project. FTE has the capability to engineer, build, turn up, test and manage every component in a client’s facility. The facilities that we work in performing ISP work are secure, highly available and mission critical to the countries telecommunications infrastructure. The client facilities that FTE works inside of touches everything from Wall Street trading floors to the video, telephone and data services used every day by the typical family and individual. This critical infrastructure connects corporate land based services, mobile data services, on-demand video, TV and cable broadcast, internet, public networks, private networks and telephone. The quality of the work product from engineering to construction in this work is critical.

Our clients engage us with confidence as is shown by our solid, standing relationships and repeat business opportunities that have been tested and forged over time.

| 8 |

Project Estimating and Feasibility Studies

Our subsidiaries share an estimating department that provides all cost needs, both internal and external, as a value-added service to telecommunications clients. For extremely difficult builds, we use a “boots on the ground” approach, ready with someone to look at the project up close, typically within 24 hours. For the bid process, the following steps are followed:

| · | A request for a proposal, or a request for information is received from a prospective customer: typically a data file is provided with a general route, cell tower locations, laterals, rings, etc. |

| · | Using Google Earth, we provide a solution based on aerial and underground construction options, utilizing the U.S. geological studies for ground conditions and “street view” programs to analyze the conditions. Additional services are often used, including: MS Streets & Trips, MapInfo, Bing Maps, Delorme, and a national database of GIS maps. At the same time, we reach out to vendors and suppliers to start assessing rough costs for materials and labor. |

| · | We specialize in complex projects with a large geographical footprint and multiple customer drop pints. This goal is met by importing the customer drop points (i.e., latitude and longitude) into whichever software program the customer has specified as the deliverable. Then, using the aforementioned methods, we identify the best installation path and verify whether the most cost-effective method of installation will be aerial, underground, or existing conduit paths. This conclusion is portrayed on the deliverable software, and the different methods of construction are clearly defined by specific colors on the reports. |

| · | The project is broken into segments with independent budgets for each segment, allowing the customer to identify the fiber size based upon end-use requirements. This all flows into a master project budget, giving the customer a snapshot that will allow them to make changes to the individual segments at their discretion based upon the budgetary information provided. |

| · | The nationwide network of project managers is utilized to analyze the geography of each part of the project and provide feedback on critical portions of the proposed build. |

| · | This all culminates into finished proposals – ones that we believe accurately represent the ideal and most cost-effective approach to the build process. Due to the process we have solidified in our estimating department, bringing in and training additional support staff typically takes less than 2 weeks. |

Customer Relationships

Our current customers include, in part, multiple Fortune 500 telecommunications and technology providers and integrators. We also provide telecommunications engineering, construction, installation and maintenance services to a number of cable television multiple system operators. Premise wiring services are provided to various corporations and state and local governments.

Our customer base is highly concentrated. Due to the fact that the majority of our revenues are non-recurring, project-based revenues, it is not unusual for there to be significant period-to-period shifts in customer concentrations. Revenue may significantly decline if the Company were to lose one or more of its significant customers, or if the Company were not able to obtain new customers upon the completion of significant contract. The Company’s strategy for the future includes customer and service diversification reducing the customer revenue concentration to less than 15% for any single customer.

During the years ended September 30, 2015 and 2014, the Company’s largest customers included a leading service provider of dark fiber and advanced network services (“Customer A”), a leading provider of wireless infrastructure solutions (“Customer B”), a multinational provider of communications technology and services (“Customer C”), a corporate staffing customer within the Company’s staffing segment (“Customer D”), a provider of large scale fiber optic cables (“Customer E”) and a telecommunications company providing fiber optic based network solutions (“Customer F”).

| 9 |

The Company’s revenues from Customer F for the years ending September 30, 2015 and 2014 were $0 and $12.3 million, respectively. The Company ceased doing business with Customer F in July 2014 and, therefore, the Company had no revenues from Customer F for the year ended September 30, 2015.

At the same time the contracted work of Customer F was coming to a close, the revenues of Customer C were increasing. During the year ended September 30, 2015, the revenues of Customer C were $5,196,380 ( 36% of total revenues). During the year ended September 30, 2014, the revenues of Customer C were $516,771 (3% of total revenues). For the year ended September 30, 2015, Customer D had revenues of $5,324,866 or 37% of total revenues. During the year ended September 30, 2014, Customer D had no revenues.

As of September 30, 2015, Customer E and Customer B represented 47% and 12% of accounts receivable, respectively. As of September 30, 2014, Customer A, Customer B and Customer C represented 41%, 18% and 13% of accounts receivable, respectively.

The following tables set forth our revenues and accounts receivable balances for the periods indicated:

| For the Years Ended | ||||||||||||||||

| September 30, | ||||||||||||||||

| Revenues | 2015 | 2014 | ||||||||||||||

| $ | % | $ | % | |||||||||||||

| Customer B | 13,776 | 0 | % | 1,327,688 | 8 | % | ||||||||||

| Customer C | 5,196,380 | 36 | % | 516,771 | 3 | % | ||||||||||

| Customer D | 5,324,866 | 37 | % | - | 0 | % | ||||||||||

| Customer F | - | 0 | % | 12,272,543 | 72 | % | ||||||||||

| All other customers | 3,853,660 | 27 | % | 2,815,029 | 17 | % | ||||||||||

| Total Revenues | $ | 14,388,682 | 100 | % | $ | 16,932,031 | 100 | % | ||||||||

| September 30, | ||||||||||||||||

| Accounts Receivable | 2015 | 2014 | ||||||||||||||

| $ | % | $ | % | |||||||||||||

| Customer A | - | 0 | % | 893,299 | 41 | % | ||||||||||

| Customer B | 152,475 | 12 | % | 401,718 | 18 | % | ||||||||||

| Customer C | 88,686 | 7 | % | 281,938 | 13 | % | ||||||||||

| Customer E | 617,825 | 47 | % | 69,754 | 3 | % | ||||||||||

| All other customers | 445,459 | 34 | % | 526,059 | 25 | % | ||||||||||

| Total accounts receivable | 1,304,445 | 100 | % | 2,172,768 | 100 | % | ||||||||||

| Less: Allowance for doubtful accounts | (89,000 | ) | (267,998 | ) | ||||||||||||

| Accounts receivable, net of allowance | $ | 1,215,445 | $ | 1,904,770 | ||||||||||||

| 10 |

Competition

The markets in which we operate are highly competitive. We compete with other contractors in most of the geographic markets in which we operate, and several of our competitors are large companies that have significant financial, technical and marketing resources. In addition, there are relatively few barriers to entry into some of the industries in which we operate and, as a result, any organization that has adequate financial resources and access to technical expertise may become a competitor. A significant portion of our revenues is currently derived from unit price or fixed price agreements, and price is often an important factor in the award of such agreements. Accordingly, we could be underbid by our competitors in an effort by them to procure such business. Economic conditions have increased the impacts of competitive pricing in certain of the markets that we serve. We believe that customers consider other factors in choosing a service provider, including technical expertise and experience, financial and operational resources, nationwide presence, industry reputation and dependability, which we expect to benefit larger contractors such as us. In addition, competition may lessen as industry resources, such as labor supplies, approach capacity. There can be no assurance, however, that our competitors will not develop the expertise, experience and resources to provide services that are superior in both price and quality to our services, or that we will be able to maintain or enhance our competitive position. We also face competition from the in-house service organizations of our existing or prospective customers, including telecommunications and engineering companies, which employ personnel who perform some of the same types of services as those provided by us. Although a significant portion of these services is currently outsourced by many of our customers, there can be no assurance that our existing or prospective customers will continue to outsource services in the future.

Regulation

Our operations are subject to various federal, state, local and international laws and regulations including:

| · | licensing, permitting and inspection requirements applicable to contractors, electricians and engineers; |

| · | regulations relating to worker safety and environmental protection; |

| · | permitting and inspection requirements applicable to construction projects; |

| · | wage and hour regulations; |

| · | regulations relating to transportation of equipment and materials, including licensing and permitting requirements; and |

| · | building and electrical codes. |

We believe that we have all the licenses required to conduct our operations and that we are in substantial compliance with applicable regulatory requirements. Our failure to comply with applicable regulations could result in substantial fines or revocation of our operating licenses, as well as give rise to termination or cancellation rights under our contracts or disqualify us from future bidding opportunities.

Safety and Risk Management

We are committed to ensuring that our employees perform their work safely and we regularly communicate with our employees to reinforce that commitment and instill safe work habits. We review accidents and claims for our operations, examine trends and implement changes in procedures to address safety issues. Claims arising in our business generally include workers’ compensation claims, various general liability and damage claims, and claims related to vehicle accidents, including personal injury and property damage. We insure against the risk of loss arising from our operations up to certain deductible limits in substantially all of the states in which we operate. In addition, we retain risk of loss, up to certain limits, under our employee group health plan.

We carefully monitor claims and actively participate with our insurers in determining claims estimates and adjustments. The estimated costs of claims are accrued as liabilities, including estimates for claims incurred but not reported. Due to fluctuations in our loss experience from year to year, insurance accruals have varied and can affect the consistency of operating margins. If we experience insurance claims in excess of our umbrella coverage limit, our business could be materially and adversely affected.

| 11 |

Seasonality

Our revenues are affected by seasonality as a significant portion of the work we perform is outdoors. Consequently, our operations are impacted by extended periods of inclement weather. Generally, inclement weather is more likely to occur during the winter season, which falls during our first and fourth fiscal quarters. Also, a disproportionate percentage of total paid holidays fall within our second quarter, which decreases the number of available workdays. Additionally, our customer premise equipment installation activities for cable providers historically decrease around calendar year-end holidays as their customers generally require less activity during this period. As a result, we may experience reduced revenue in the second or third quarters of our fiscal years.

Environmental Matters

A significant portion of our work is performed underground. As a result, we are potentially subject to material liabilities related to encountering underground objects which may cause the release of hazardous materials or substances. Additionally, the environmental laws and regulations which relate to our business include those regarding the removal and remediation of hazardous substances and waste. These laws and regulations can impose significant fines and criminal sanctions for violations. Costs associated with the discharge of hazardous materials or substances may include clean-up costs and related damages or liabilities. These costs could be significant and could adversely affect our results of operations and cash flows.

STAFFING INDUSTRY

Effective May 8, 2014, we operate a temporary and permanent staffing agency providing full service human capital solutions specializing in telecommunications, construction, engineering and technology through our wholly owned subsidiary, FVP Worx. FVP Worx is growing its leadership position in the staffing industry serving a base of clients ranging from the Fortune 500 to medium-sized businesses and entrepreneurial start-ups. FVP Worx provides direct staffing, interim staffing, consulting services and outsourcing services. Through key service offerings in IT consulting and staff augmentation, we deliver measurable results that drive positive financial outcomes. We focus on strong ROI and technology solutions, which are vital in today’s hyper competitive environment.

We offer complete staff augmentation services including temporary, temporary-to-hire, and full-time permanent placement. Our services include all of the following:

| · | Payroll |

| · | Insurance |

| · | Benefits plans |

| · | Candidate recruiting and selection |

| · | Developing expertise with leading-edge technologies |

| · | Supplying per-diem staff on an as-needed basis |

| · | Training staff on client-specific processes |

The temporary staffing industry evolved out of the need for a flexible workforce to minimize the cost and effort of hiring and administering permanent employees in order to rapidly respond to changes in business conditions and to temporarily replace absent employees. Competitive pressures have forced businesses to focus on reducing costs, including converting fixed or permanent labor costs to variable or flexible costs. The temporary staffing industry includes a number of markets focusing on business needs that vary widely in duration of assignment and level of technical specialization. We operate within the telecommunications staffing market of the temporary staffing industry.

| 12 |

Temporary staffing companies act as intermediaries in matching available temporary workers to employer assignments. Staffing companies compete both to recruit and retain a supply of temporary workers and to attract and retain customers to employ these workers. An important aspect in the selection of temporary workers for an assignment is the ability to identify the skills, knowledge, abilities of a temporary worker and match their competencies or capabilities to an employer’s requirements. Methods used to sell temporary staffing services to customers vary depending on the customer’s need for temporary staffing services, the local labor supply, the length of assignment, the number of workers and skills required. We are a business-to-business sales provider. Our sales process takes place at the customer’s location. Success is often based on the experience and skill of the sales person and the strength of relationship with the customer. Retention of customers, exclusive of economic conditions, is dependent on the strength of our relationship with the customer, the skill, quality and tenure of temporary workers, and customer service skills.

The temporary staffing industry is large and highly fragmented with many competing companies. No single company has a dominant share of the temporary staffing industry. Customer demand for temporary staffing services is dependent on the overall strength of the labor market and trends toward greater workforce flexibility.

The staffing industry is cyclical based on overall economic conditions. Historically, in periods of economic growth, the number of companies providing temporary staffing services has increased due to low barriers to entry and during recessionary periods the number of companies has decreased through consolidation, bankruptcies, or other events. The temporary staffing industry experienced increased volatility during the most recent recession in comparison with past economic cycles. This is largely due to the severity of the recession which resulted in a dramatic drop in the use of temporary staffing as companies aggressively reduced the size of their workforce. However, in the post recessionary environment, the temporary staffing industry is experiencing increased demand in relation to total job growth as customers have placed a greater priority on maintaining a more flexible workforce.

Customers

Our customer mix consists primarily of small and medium sized businesses. We also serve larger national customers. Our full range of temporary staffing services enables us to meet all of the staffing needs of our customers.

Competition

We compete in the temporary staffing industry by offering a full range of staffing services. The temporary staffing industry is large and fragmented, comprised of thousands of companies employing millions of people and generating billions of dollars in annual revenues.

We experience competition in attracting customers as well as qualified employment candidates. The staffing business is highly competitive with limited barriers to entry, with a number of firms offering services similar to those provided by us on a national, regional, or local basis. We compete with several multi-national full-service and specialized temporary staffing companies, as well as a multitude of local companies. In most geographic areas, no single company has a dominant share of the market. The majority of temporary staffing companies serving the staffing market are locally owned businesses. In many areas the local companies are the strongest competitors, largely due to their longevity in the market and the strength of their customer relationships.

Competitive forces have historically limited our ability to raise our prices to immediately and fully offset increased costs of doing business; some of which include increased temporary worker wages, costs for workers’ compensation, and unemployment insurance.

| 13 |

The most significant competitive factors in the staffing business are price, ability to promptly fill customer orders, success in meeting customers’ quality expectations of temporary workers, and appropriately addressing customer service issues. We believe we derive a competitive advantage from our service history and commitment to the temporary employment market and our specialized approach in serving the industries of our customers. Also, we believe that our national presence and proprietary systems and programs including worker safety, risk management, and legal and regulatory compliance are key differentiators from many of our competitors.

Segment Reporting

We operate in the telecommunications infrastructure services industry and, effective May 8, 2014, entered the staffing industry. For the year ended September 30, 2014, our staffing business was in the development stage and only generated negligible revenues and expenses. Consequently, we concluded that the staffing business did not qualify as a separate segment for the year ended September 30, 2014. We reported segment results pursuant to ASC 280-10 “Segment Reporting” for the year ended September 30, 2015.

EMPLOYEES

As of January 8, 2016, we, together with our subsidiaries, employ 232 full-time employees and 8 part-time employees. None of our employees are represented by local collective bargaining units. The number of our employees varies according to the level of our work in progress. We maintain a nucleus of technical and managerial personnel to supervise all projects and add employees as needed to complete specific projects.

ACQUISITION STRATEGY

With respect to our acquisition strategy, FTE intends to pursue a clearly defined telecommunications niche, but may, in its discretion, pursue acquisitions outside of this niche, although this will not be our focus. We selectively pursue acquisitions when we believe doing so is operationally and financially beneficial to our existing operations, although we do not rely solely on acquisitions for growth. In particular, we may pursue those acquisitions that we believe will provide us with incremental revenue and geographic diversification while complementing our existing operations. We generally target companies for acquisition that have defensible leadership positions in their market niches, are EBITDA positive, which meet or exceed industry averages, and have proven operating histories, sound management, and certain clearly identifiable cost synergies.

| 14 |

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Annual Report on Form 10-K, before making an investment decision, and you should only consider an investment in our common stock if you can afford to sustain the loss of your entire investment. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Corporate Risks

The Company may not be able to maintain sufficient liquidity.

In the year ended September 30, 2015, we recorded a net loss of $3,554,914 and we used $64,392 of cash in operating activities. As of September 30, 2015, we have a working capital deficiency of $6.4 million, which includes $1.8 million of unpaid payroll tax liabilities associated with our staffing segment, plus related penalties and interest. If we don’t satisfy the payroll tax obligation as planned, it is possible that we could be subject to additional fines and penalties. Subsequent to September 30, 2015, we closed on an $8 million credit facility, of which (a) $1.8 million was used to extinguish $3.5 million of senior secured notes and $1.8 million of related accrued interest; and (b) $3.0 million was deposited into a restricted Company bank account which requires the credit provider’s approval to utilize. The Company will need to continue to monitor its liquidity and many need to raise additional funds until it begins to generate cash from operating activities.

We depend upon key personnel and need additional personnel.

Our success depends on the continuing services of the executive team. Additionally, the success of our operations will largely depend upon our ability to successfully attract and maintain competent and qualified key management personnel. As with any company with limited resources, there can be no guaranty that we will be able to attract such individuals or that the presence of such individuals will necessarily translate into profitability for us. Our inability to attract and retain key personnel may materially and adversely affect our business operations.

FTE’s operation as a public company subjects it to extensive corporate governance and disclosure regulations that may strain our resources, increase our costs and distract management, and we may be unable to comply with these requirements in a timely or cost-effective manner.

As a public company, FTE incurs significant legal and accounting expenses associated with its public company reporting requirements. In addition, like many smaller public companies, FTE faces a significant impact from required compliance with Section 404 of the Sarbanes-Oxley Act of 2002. Section 404 requires management of public companies to evaluate the effectiveness of internal control over financial reporting. The SEC has adopted rules implementing Section 404 for public companies as well as disclosure requirements. Any failure to implement effective or improved internal controls, or to resolve difficulties encountered in their implementation, could harm FTE’s operating results, or cause a failure to meet reporting obligations or result in management assessing internal control over financial reporting as not effective. Further, we have, in the past, failed to comply with our reporting obligations, which resulted in the revocation of the registration of our Securities (see “The Registration and Trading of Our Securities,” beginning on page 5 above). Now that our common stock is registered again, we are again subject to the reporting requirements of Regulation 13(a) of the Exchange Act. Any failure to implement effective internal controls, or to meet our reporting obligations could cause investors to lose confidence in FTE’s reported financial information, which could have a material adverse effect on our stock price.

| 15 |

Risks Associated with the Telecommunications Industry

We possess a significant amount of accounts receivable and if we are unable to collect account receivables in a timely manner or at all, our cash flow and profitability will be negative impacted, which such risk is heightened during unstable economic periods

We extend credit to our customers as a result of performing work under contract prior to billing our customers for that work. These customers include telephone companies, cable television multiple system operators and others. We had net accounts receivable of approximately $1.2 million at September 30, 2015 and $1.9 million at September 30, 2014. We periodically assess the credit risk of our customers and continuously monitor the timeliness of payments. Slowdowns in the industries we serve may impair the financial condition of one or more of our customers and hinder their ability to pay us on a timely basis or at all. Further bankruptcies or financial difficulties within the telecommunications sector could hinder the ability of our customers to pay us on a timely basis or at all, reducing our cash flows and adversely impacting our liquidity and profitability. Additionally, we could incur losses in excess of current bad debt allowances. The Company recognized approximately $0.4 million and $0.3 million in bad debt expense in the years ended September 30, 2015 and 2014, respectively.

We must effectively manage the growth of our operations and effectively integrate acquisitions, or our company will suffer.

To manage our growth and effectively integrate acquisitions, we believe we must continue to implement and improve our operations. We may not have adequately evaluated the costs and risks associated with this expansion, and our systems, procedures, and controls may not be adequate to support our operations. In addition, our management may not be able to achieve the rapid execution necessary to successfully offer our products and services and implement our business plan on a profitable basis. The success of our future operating activities will also depend upon our ability to expand our support system to meet the demands of our growing business. Any failure by our management to effectively anticipate, implement, and manage changes required to sustain our growth would have a material adverse effect on our business, financial condition, and results of operations.

We derive a significant portion of our revenues from a limited number of customers, and the loss of one or more of these customers could adversely impact our revenues and profitability.

Our customer base is highly concentrated. As of September 30, 2015, Customer E and Customer B represented 47% and 12% of accounts receivable, respectively. As of September 30, 2014, Customer A, Customer B and Customer C represented 41%, 18% and 13% of accounts receivable, respectively.

For the year ended September 30, 2015, Customer D represented approximately 37% of revenues and Customer C represented approximately 36% of revenues. For the year ended September 30, 2014, Customer F represented approximately 72% of revenues.

Our revenue may significantly decline if we were to lose one or more of our significant customers. In addition, revenues under our contracts with significant customers may vary from period to period depending on the timing and volume of work which those customers order or perform with their in-house service organizations. Additionally, consolidations, mergers and acquisitions in the telecommunications and staffing industries have occurred in the past and may occur in the future. The consolidation, merger or acquisition of an existing customer may result in a change in procurement strategies by the surviving entity. Reduced demand for our services or a change in procurement strategy of a significant customer could adversely affect our results of operations, cash flows and liquidity.

| 16 |

There is competition for those private companies suitable for a merger transaction of the type contemplated by management.

We are in a highly competitive market for a small number of telecommunications business opportunities which could reduce the likelihood of implementing our acquisition strategy. We are and will continue to be an insignificant participant in the business of seeking acquisitions in the telecommunications space. A large number of established and well financed entities, including small public companies and venture capital firms, are active in mergers and acquisitions of companies that may be desirable target candidates for us. Nearly all these entities have significantly greater financial resources, technical expertise and managerial capabilities than we do; consequently, we will be at a competitive disadvantage in identifying possible business opportunities and successfully completing a business combination. These competitive factors may reduce the likelihood of implementing our business strategy.

Failure to integrate future acquisitions successfully could adversely affect our business and results of operations.

As part of our growth strategy, we may acquire companies that expand, complement, or diversify our business. We regularly review various opportunities and periodically engage in discussions regarding possible acquisitions. Future acquisitions may expose us to operational challenges and risks, including the diversion of management’s attention from our existing business, the failure to retain key personnel or customers of an acquired business, the assumption of unknown liabilities of the acquired business for which there are inadequate reserves and the potential impairment of acquired intangible assets. Our ability to sustain our growth and maintain our competitive position may be affected by our ability to successfully integrate any businesses acquired.

Service level agreements in our customer agreements could subject us to liability or the loss of revenue.

Our contracts with customers typically contain service guarantees and service delivery date targets, which if not met by us, enable customers to claim credits against their payments to us and, under certain conditions, terminate their agreements. Our inability to meet our service level guarantees could adversely affect our revenue and cash flow. While we typically have carve-outs for force majeure events, many events, such as fiber cuts, equipment failure and third-party vendors being unable to meet their underlying commitments or service level agreements with us, could impact our ability to meet our service level agreements and are potentially out of our control.

Our backlog is subject to reduction and/or cancellation.

Our backlog consists of the uncompleted portion of services to be performed under job-specific contracts and the estimated value of future services that we expect to provide under master service agreements and other long-term requirements contracts. Many of our contracts are multi-year agreements, and we include in our backlog the amount of services projected to be performed over the terms of the contracts based on our historical experience with customers and, more generally our experience in procurements of this type. In many instances, our customers are not contractually committed to procure specific volumes of services under a contract. Our estimates of a customer’s requirements during a particular future period may not prove to be accurate, particularly in light of the current economic conditions and the uncertainty that imposes on changes in our customer’s requirements for our services. If our estimated backlog is significantly inaccurate or does not result in future profits, this could adversely affect our future growth and the price of our common stock.

Legislative actions and initiatives relating to telecommunications may not result in an increase in demand for our services.

The American Recovery and Reinvestment Act of 2009 (“ARRA”) originally allocated $7.2 billion in funding to accelerate broadband deployment in rural areas of the country that have been without high-speed infrastructure. However, we cannot predict the actual benefits to us from the implementation of ARRA programs. For example, significant additional contracts resulting from investments for rural broadband deployment under the ARRA may not be awarded to us.

| 17 |

If we do not adapt to swift changes in the telecommunications industry, we could lose customers or market share.

The telecommunications industry is characterized by rapidly changing technology, evolving industry standards, frequent new service introductions, shifting distribution channels and changing customer demands. We may not be able to adequately adapt our services or acquire new services that can compete successfully. Our failure to obtain and integrate new technologies and applications could impact the breadth of our service portfolio resulting in service gaps, a less differentiated service suite and a less compelling offering to customers. We risk losing customers to our competitors if we are unable to adapt to this rapidly evolving marketplace.

In addition, the introduction of new services or technologies, as the well as the further development of existing services and technologies, may reduce the cost or increase the supply of certain services similar to those that we provide. As a result, our most significant competitors in the future may be new entrants to the telecommunications industry. These new entrants may not be burdened by an installed base of outdated equipment or obsolete technology. Our future success depends, in part, on our ability to anticipate and adapt in a timely manner to technological changes. Failure to do so could have a material adverse effect on our business.

Any failure of our physical infrastructure or services could lead to significant costs and disruptions that could reduce our revenues, harm our business reputation, and have a material adverse effect on our financial results.

Our business depends on providing customers with highly reliable service. The services we provide are subject to failure resulting from numerous factors, including:

| • | human error; |

| • | power loss; |

| • | physical or electronic security breaches; |

| • | fire, earthquake, hurricane, flood, and other natural disasters; |

| • | water damage; |

| • | the effect of war, terrorism, and any related conflicts or similar events worldwide; and |

| • | sabotage and vandalism. |

Problems within our network, whether or not within our control, could result in service interruptions or equipment damage. In the past, we have at times experienced instability in our equipment attributed to equipment failure and power outages. Although such disruptions have been remedied and the network has been stabilized, there can be no assurance that similar disruptions will not occur in the future. We have service level commitment obligations with substantially all of our customers. As a result, service interruptions or equipment damage could result in credits for service interruptions to these customers. We have at times in the past given credits to our customers as a result of service interruptions due to equipment failures. We cannot assume that our customers will accept these credits as compensation in the future. Also, service interruptions and equipment failures may expose us to additional legal liability.

| 18 |

We are subject to significant regulation that could change or otherwise impact us in an adverse manner.

Our operations are subject to various federal, state and local laws and regulations including:

| - | licensing, permitting and inspection requirements applicable to contractors, electricians and engineers; |

| - | regulations relating to worker safety and environmental protection; |

| - | permitting and inspection requirements applicable to construction projects; |

| - | wage and hour regulations; |

| - | regulations relating to transportation of equipment and materials, including licensing and permitting requirements; and |

| - | building and electrical codes. |

We believe that we have all the licenses required to conduct our operations and that we are in substantial compliance with applicable regulatory requirements. Our failure to comply with applicable regulations could result in substantial fines or revocation of our operating licenses, as well as give rise to termination or cancellation rights under our contracts or disqualify us from future bidding opportunities.

Risks Associated with the Staffing Industry

Our staffing business is significantly affected by fluctuations in general economic conditions.

The demand for our staffing services is highly dependent upon the state of the economy and upon staffing needs of our customers. Any variation in the economic condition or unemployment levels of the United States or in the economic condition of any region or telecommunications industry in which we have a significant presence may severely reduce the demand for our services and thereby significantly decrease our revenues and profits.

Our staffing business is subject to extensive government regulation and a failure to comply with regulations could materially harm our business.

Our business is subject to extensive regulation. The cost to comply, and any inability to comply, with government regulation could materially harm our business. Increased government regulation of the workplace or of the employer-employee relationship, or judicial or administrative proceedings related to such regulation, could materially harm our business.

The Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (collectively, the “Health Care Reform Laws”) include various health-related provisions to take effect through 2014, including requiring most individuals to have health insurance and establishing new regulations on health plans. Although the Health Care Reform Laws do not mandate that employers offer health insurance, beginning in 2014 penalties will be assessed on certain employers who do not offer health insurance that meets certain affordability or benefit requirements. Unless modified by regulations or subsequent legislation, providing such additional health insurance benefits to our temporary workers, or the payment of penalties if such coverage is not provided, would increase our costs. If we are unable to raise the rates that we charge our customers to cover these costs, such increases in costs could materially harm our business.

| 19 |

We may incur employment related and other claims that could materially harm our business.

We employ individuals on a temporary basis and places them in our customers' workplaces. We have minimal control over our customers' workplace environments. As the employer of record of these temporary workers, we incur a risk of liability for various workplace events, including claims for personal injury, wage and hour requirements, discrimination or harassment, and other actions or inactions of our temporary workers. In addition, some or all of these claims may give rise to litigation including class action litigation. Although we currently believe resolving all of these matters, individually or in the aggregate, will not have a material adverse impact on our financial statements, the litigation and other claims are subject to inherent uncertainties and our view of these matters may change in the future. A material adverse impact on our financial statements also could occur for the period in which the effect of an unfavorable final outcome becomes probable and can be reasonably estimated.

We cannot be certain that our insurance will be sufficient in amount or scope to cover all claims that may be asserted against us. Should the ultimate judgments or settlements exceed our insurance coverage, they could have a material effect on our business. We cannot be certain we will be able to obtain appropriate types or levels of insurance in the future, that adequate replacement policies will be available on acceptable terms, if at all, or that the companies from which we have obtained insurance will be able to pay claims we make under such policies.

We are dependent on workers' compensation insurance coverage at commercially reasonable terms.

We provides workers' compensation insurance for our temporary workers. Our workers' compensation insurance policies are renewed annually. We cannot be certain that we will be able to obtain appropriate types or levels of insurance in the future or that adequate replacement policies will be available on acceptable terms, if at all. The loss of our workers' compensation insurance coverage would prevent us from doing business in the majority of our markets. Further, we cannot be certain that our current and former insurance carriers will be able to pay claims that we make under such policies. These additional sources of capital may not be available on commercially reasonable terms, or at all.

We operate in a highly competitive business and may be unable to retain customers or market share

The staffing services business is highly competitive and the barriers to entry are low. There are new competitors entering the market which may increase pricing pressures. In addition, long-term contracts form only a small portion of our revenue. Therefore, there can be no assurance that we will be able to retain customers or market share in the future. Nor can there be any assurance that we will, in light of competitive pressures, be able to remain profitable or, if profitable, maintain our current profit margins.

Our results of operations could materially deteriorate if we fail to attract, develop and retain qualified employees.

Our performance is dependent on attracting and retaining qualified employees who are able to meet the needs of our customers. We believe our competitive advantage is providing unique solutions for each individual customer, which requires us to have highly trained and engaged employees. Our success depends upon our ability to attract, develop and retain a sufficient number of qualified employees, including management, sales, recruiting, service and administrative personnel. The turnover rate in the staffing industry is high, and qualified individuals of the requisite caliber and number needed to fill these positions may be in short supply. Our inability to recruit a sufficient number of qualified individuals may delay or affect the speed of our planned growth or strategy change. Delayed expansion, significant increases in employee turnover rates or significant increases in labor costs could have a material adverse effect on our business, financial condition and results of operations.

| 20 |

Risks Associated with our Securities

A significant number of additional shares of our common stock may be issued upon the exercise or conversion of existing securities, which issuances would substantially dilute existing stockholders and may depress the market price of our common stock.

As of September 30, 2015, we had outstanding shares of Series A, Series A-1, and Series D preferred stock convertible into an aggregate of 733,364,414 shares of common stock, outstanding warrants for the purchase of securities equivalent to 40,141,799 shares of common stock, and a note payable convertible into 200,000 shares of common stock. The Series D shares are automatically convertible at a rate of 400 shares of common stock on a pre-reverse-split basis (the equivalent of 20 shares of common stock after the effect of the 1-for-20 reverse stock split) for each preferred stock only upon (a) a sufficient increase in the authorized common shares and (b) the implementation of a 1-for-20 reverse split of the common shares. The issuance of these shares of common stock will substantially dilute the proportionate ownership and voting power of existing stockholders, and their issuance, or the possibility of their issuance, may depress the market price of our common stock.

We pay no dividends.

We have never paid cash dividends in the past, and currently do not intend to pay any cash dividends in the foreseeable future.

There is, at present, only a limited market for our common stock and there is no assurance that an active trading market for our common stock will develop.

Although our common stock is quoted on the OTC Pink marketplace from time to time, the market for our common stock is extremely limited. In addition, although there have been market makers in our securities, we cannot assure that these market makers will continue to make a market in our securities or that other factors outside of our control will not cause them to stop market making in our securities. Making a market in securities involves maintaining bid and ask quotations and being able to effect transactions in reasonable quantities at those quoted prices, subject to various securities laws and other regulatory requirements. Furthermore, the development and maintenance of a public trading market depends upon the existence of willing buyers and sellers, the presence of which is not within our control or that of any market maker. Market makers are not required to maintain a continuous two-sided market, are required to honor firm quotations for only a limited number of shares, and are free to withdraw firm quotations at any time. Even with a market maker, factors such as our past losses from operations and the small size of our company mean that there can be no assurance of an active and liquid market for our securities developing in the foreseeable future. Even if a market develops, we cannot assure that a market will continue, or that shareholders will be able to resell their securities at any price.

Since our common stock is classified as “penny stock,” the restrictions of the SEC’s penny stock regulations may result in less liquidity for our common stock.